how to buy tax liens in maricopa county

On an annual basis your return could be as high as 120. Tax liens pay out a flat fee of 10 for the first 6 months or 15 for the second 6 months.

Maricopa County Assessor S Office

If the property owner cannot pay past-due taxes the treasurer offers a tax certificate for purchase at a public auction.

. Administration Building 130 High Street 2nd Floor - Hamilton OH 45011 Phone. Days of our Lives DOOL spoilers reveal that Stefan DiMera Brandon Barash could rise again like a phoenix just like his father Stefano DiMera the late Joseph Mascolo did so many times before him. A tax lien is a legal claim that a local or municipal government places on an individuals property when the owner has failed to pay a property tax debt.

Both represent sales of homes with unpaid property taxes. CountyArizonainCase 6Map 35A and35B asamended from. Got a paper in the mail saying oerviouse owner owes 8000 in back taxes I live in Butler county.

Tax liens can yield 18 over 6 months - thats 36 per year. Joaquin Valley California who sells homes 63 faster than the average agent in the region. In the second ruling Maricopa County Superior Court Judge Joseph Mikitish rejected similar challenges to petitions gathered to qualify the.

A real-world example of a quieted title was an easement for a specifically named woman to cross the property to access a community as well. Welcome to the world of Maricopa County Arizonas Tax Liens. Section 8 homes for rent clayton county The vouchers can be used by qualified low income families as a form of subsidy on their monthly rent payments.

Please call 713-274-8000 or send an email to email protected to receive a payment amount for your 2021 property taxes. Your local tax agency may be able to provide information on when tax lien auctions take place according to the National Tax Lien Association NTLA. You are still responsible for payment of your property taxes even if you have not received a copy of your property tax statement s.

In the second ruling Maricopa County Superior Court Judge Joseph Mikitish rejected similar challenges to petitions gathered to qualify the. Nov issue a county maps that fee for sales through coconino counties will be a few options for a history. The ruling by Maricopa County Superior Court Judge Frank Moskowitz also turned away an argument by the attorney for a newly created group funded by Arizona debt collection agencies that alleged that paid petition circulators were improperly registered with the secretary of states office.

Danny Crank Butler County Recorder. Tax lien sale homes and tax deed sale homes. Vincent de Paul can be reached at 770 477-2388.

A tax lien sale is when the liens are auctioned off to. Arizona Statute Title 42 Ch 18 Art 3. If you do not have access to a computer the Treasurers Office will provide public access computers by appointment at designated locations.

In the second ruling Maricopa County Superior Court Judge Joseph Mikitish rejected similar challenges to petitions gathered to qualify the. In Arizona you buy tax liens by bidding down the interest you will accept. There is usually waiting list for the program.

Pursuant to Arizona Revised Statutes Title 42 Chapter 18 Article 3 Sections 42-18101 through 42-18126. A tax lien is a claim the government makes on a property when the owner fails to pay the property taxes. Hence members of the public buy tax liens to obtain property ownership or to obtain very high-interest rates.

There are two types of tax sale homes. A vacation home at the beach is a great place to get away for weekend respites or long summer stretches. A tax history search will be able to tell you the propertys value at the time of assessment past taxes paid whether any taxes are due and if there are any liens on the property.

The 2021 property taxes are due January 31 2022. DOOL fans know to expect the unexpected and right now there is a chain of events unfolding that look to spell trouble in Salem. Just select the county in Arizona that you want to look for a property below.

The statute of limitations for most debts starts when you go into default. On an annualized basis your return can be an impressive 60. After a municipality issues a tax lien.

Tax liens can pay 18 per year. The property owner has three years to redeem the lien. Largest County Is Maricopa County.

If youre interested in tax lien investing the first step is finding tax liens for sale at auction. Such as those targeted by judgment liens obtained by. The interest rate starts at 16.

Weve also got awesome deals on top of incredible foreclosure deals from rent-to-own homes short sales and preforeclosures in Arizona as well as bankruptcy filings and government-owned foreclosure listings such as HUD Fannie Mae and Freddie Mac among others. The Tax Lien Sale of unpaid 2020 real property taxes will be held on and closed on Tuesday February 8 2022. Once you know when a tax lien auction is scheduled you can plan to attend.

Direct assessments buy a property in a certain location. It also depends on when you made the last payment. Just when the devil gets vanquished up.

A qualified personal residence trust or QPRT can provide estate and gift tax savings but they also can be complicated to set up and maintain May 02 2022 3 min read Estate Planning. 10 best places to buy a beach house in 2022. If a mobile home seller has a clear title with no liens there will be little resistance in transferring the mobile home ownership from the current seller to the new buyer unless there are other title issues discussed in this article and video.

203 Hightower St Jonesboro Georgia 30236 770 478-7282. Yes Liens Only. Liens are sold at auctions that sometimes involve bidding wars.

An Ordinance authorizing the cry of bracket of Flagstaff Property in Koch Field. There were properties and establishing an offer alternative fee on time periods that county tax lien certificates today to view. Investors in Arizona can purchase tax liens at auctions in the same way they bid for and purchase real properties.

Sales are held in February. The Treasurers tax lien auction web site will be available 1252022 for both research and registration. If no one disputes the action the title would be quieted and the land would be replanted as its surveyed.

If a debt is 10 years old but you were making payments until 3 years ago the debt is likely still within the statute of limitations and can be pursued by a debt collector. Clayton County Society of St.

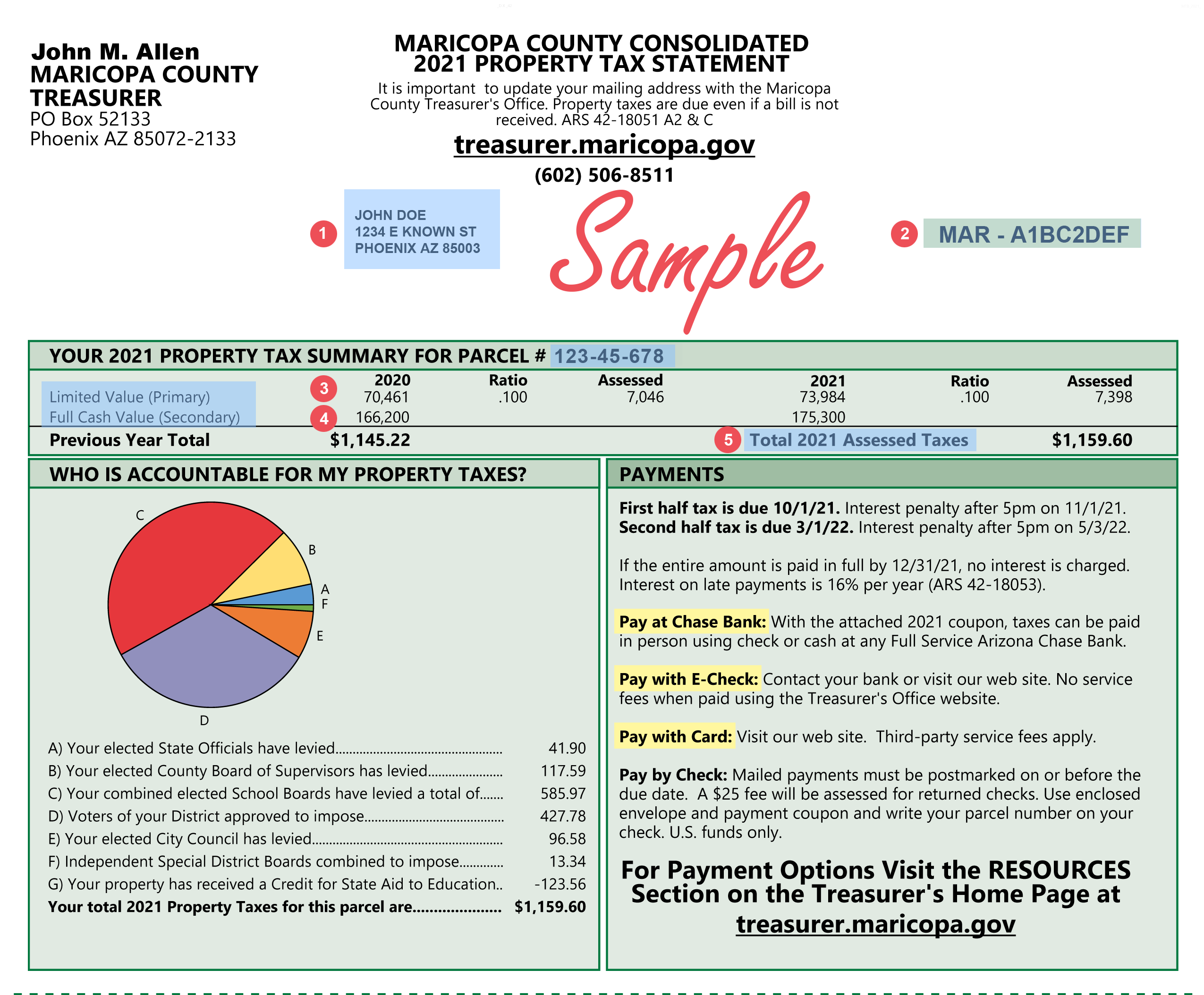

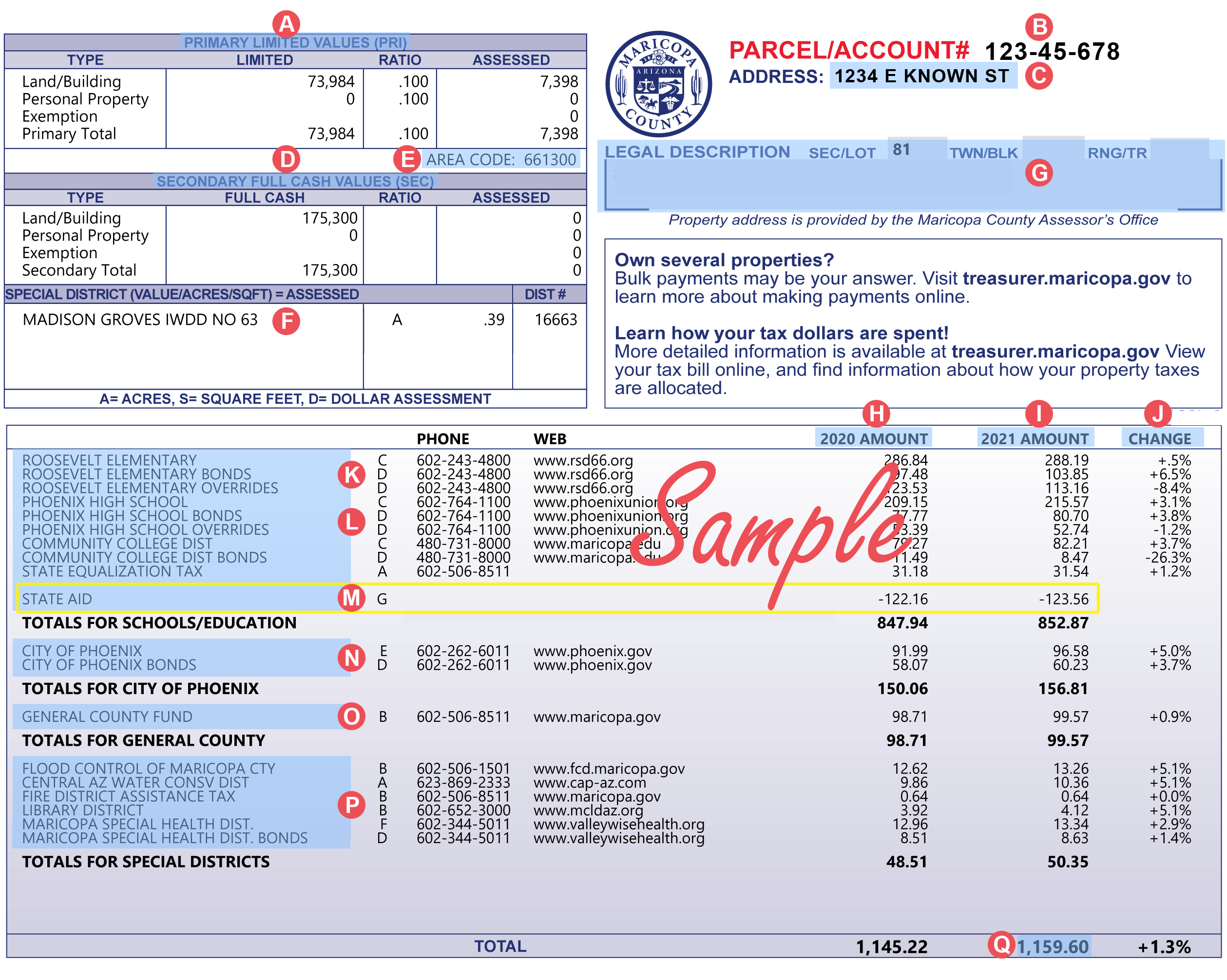

Maricopa County Treasurer S Office John M Allen Treasurer

Maricopa County Treasurer S Office John M Allen Treasurer

How Do I Maricopa County Assessor S Office

Maricopa County Arizona 48 X 36 Paper Wall Map Home Kitchen Amazon Com

Maricopa County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Maricopa County Assessor Interactive Map Government Affairs

2022 Elections Battlegrounds To Watch Maricopa County Arizona Politico

Maricopa County Zip Code Map Area Rate Map Metro Map Zip Code Map Map

Maricopa County Approves 3 4 Billion Budget With Reduced Property Tax Rate

Pha Annual Plan 2021 2022 Housing Authority Of Maricopa County

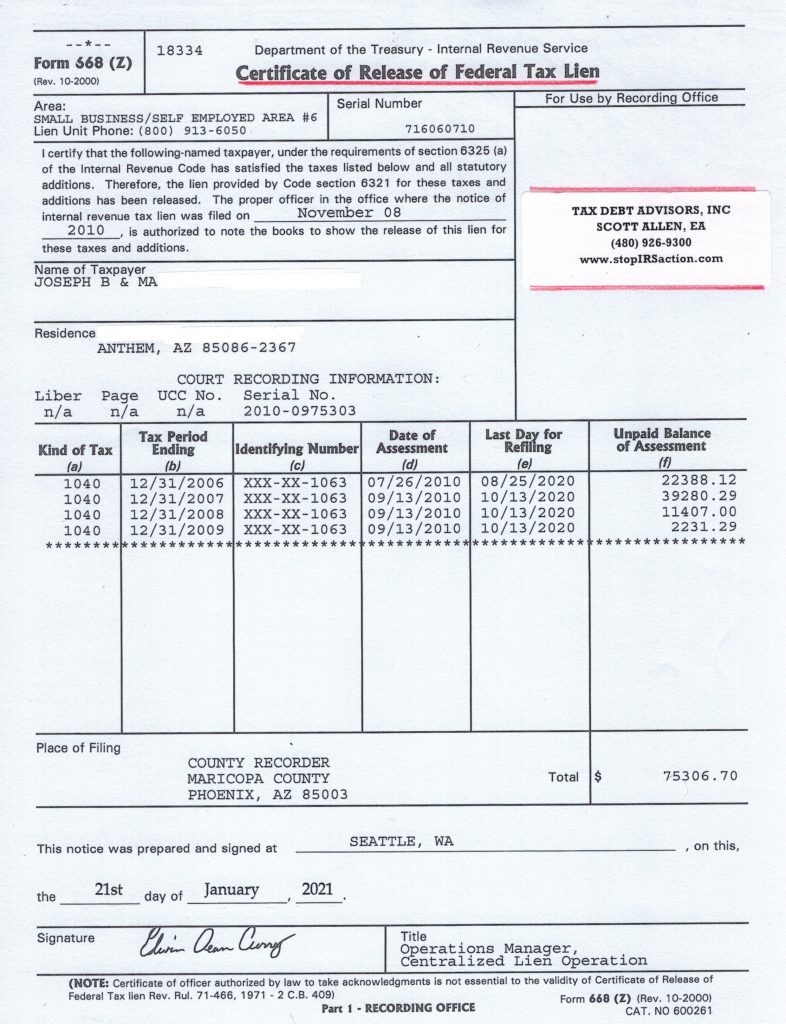

Irs Tax Lien In Arizona Irs Help From Tax Debt Advisors Inc Tax Debt Advisors

Maricopa County Approves 3b 2021 Budget Azbex

Auctions Leases Maricopa County Az

City Limits Maricopa County Az

Displaced In America Housing Loss In Maricopa County Arizona